Repercussions of the Ashley Madison Hack Still Mounting

Up until July, 2015, the dating site Ashley Madison was known for it’s sleazy tagline, late night commercials, and oddly direct and explicit marketing towards married men. But other than that, few people had much to say about the site: it existed since the early 2000’s as something of an immoral outlier in the internet dating scene, but most people just assumed that no one they knew used the site, or that the whole thing was some kind of sick joke. Nowadays, Ashley Madison users and the general public alike have come to realize that the site was all too serious, as victims of the high profile “Ashley Madison hack” are beginning to feel repercussions from their involvement with the dating service. Here’s what happened.

Ashley Madison Hack: a Brief Timeline

If you haven’t been following the news surrounding the Ashley Madison hack, here’s a quick look at the timeline of what’s transpired so far to get you up to speed. On July 15th, 2015, a group of hackers called “Impact Team” announced that they had stolen Ashley Madison’s consumer data, and would release all of the information unless some demands were met. Namely, “Impact Team,” had some big issues with the fact that Ashley Madison charged users who hoped to leave the service a $19 dollar fee to delete their data, and then apparently didn’t erase user information as promised. “Impact Team” called for a total shutdown of Ashley Madison and sister site EstablishedMen.com.

When Avid Life Media, Ashley Madison’s parent company, did not take any measures to shut down either site, “Impact Team” followed through with their promise. On July 22nd, the first user data was published. By August 18th, all of the user data for customers of the site was made public. Today, you can search through a number of online services to see if you or someone you know had their information released, and all of the customer information of everyone on the site is essentially now public knowledge.

The Repercussions of the Ashley Madison Hack

From a personal perspective, the individuals whose information was released through the Ashley Madison hack are facing a whole lot of scrutiny. The site’s tagline is “Life is short. Have an affair.” so it’s somewhat hard to argue that anyone with an account didn’t intend to participate in some extramarital activity. Some user profiles were created with other people’s email addresses, so there are some entirely innocent victims in all of this. But for the most part, most users who have had their information leaked had to know that their membership on the site wasn’t the most moral of choices.

Now, with the information being released, the lives of Ashley Madison members will be changed forever. In some cases, families are getting pulled apart, as wives reasonably confront their spouses and demand a divorce. In other cases, individuals are losing their jobs, as employers with morality clauses in their contracts point to the leaked information and demand resignations. Just about no one who had their information leaked is going to come out unscathed, and the repercussions of the hack are still developing.

Release of Private Information

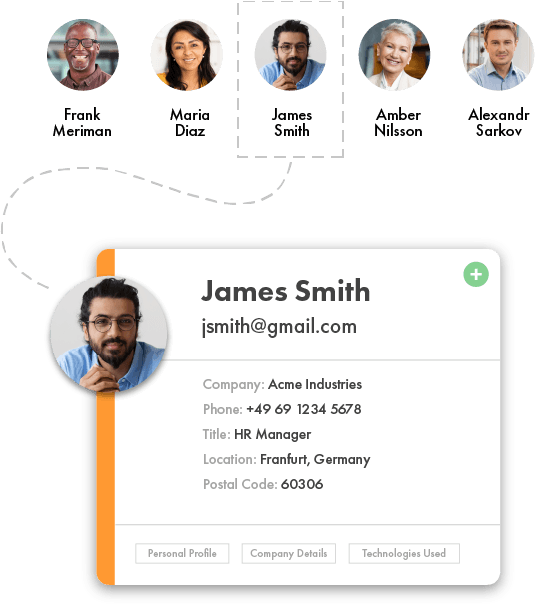

Early search sites allowed anyone who was curious to plug-in an email and see if there was an attached Ashley Madison account. But now, search indexes are releasing and cataloguing a lot more information, and you can easily and quickly pull up a whole ton of private information on anyone affected by the hack. Some search sites are even publishing the home addresses of Ashley Madison members, ostensibly to get innocent people off of the hook whose emails may have been entered as a prank or incorrectly. But what these search engines really amount to is a massive invasion of privacy, as so much private information being in the public domain has a big effect on victims,

Advertisers have already started taking advantage of this information to spam Ashley Madison members with junk mail and product offers. Some search sites are even reaching out directly to those whose information is discovered, advertising the services of private investigators and other directed products as obscure as STD tests and as grim as divorce attorneys. And this is probably just the beginning: with so much information being public, it’s only a matter of time before more people exploit it.

Is Your Data Ever Safe Online?

The short answer to this question is no. No matter what kinds of sites you frequent online, your data is never entirely safe once it has been entered, especially when it is associated with a user profile. Every website out there can be hacked; Ashley Madison is the most recent, but there are plenty of other example of hackers finding their ways into private personal data repositories.

Which begs another question: what exactly were Ashley Madison members thinking when they entered so much personal information on the site? If you want to keep yourself safe, it’s a good practice to enter as little info as possible online, especially to a site as dubious as Ashley Madison. And if you do enter your personal information freely around the internet, don’t be too surprised if that information is someday made public.